Explore how tokenized real-world assets (RWA) are reshaping finance in 2025. From BlackRock’s tokenized funds to MakerDAO’s RWA vaults, discover the trillion-dollar Web3 opportunity.

In 2025, one of the most powerful narratives reshaping Web3 is the tokenization of real-world assets (RWA). Unlike speculative meme coins or purely digital NFTs, RWAs link blockchain to tangible value: government bonds, real estate, equities, commodities, and even fine art. Traditional finance giants like BlackRock, JPMorgan, and Goldman Sachs are now experimenting with RWA tokenization, while Web3-native protocols like MakerDAO, Centrifuge, and Maple Finance are building decentralized pipelines for this trillion-dollar market. The promise is clear: tokenization unlocks liquidity, accessibility, and transparency, enabling global investors to trade traditionally illiquid assets instantly, 24/7, and at a fraction of today’s costs. But the path forward involves both opportunities and obstacles—ranging from regulatory battles to technical interoperability.

What Are Tokenized Real-World Assets?

At its core, tokenization is the process of representing ownership of a real-world asset as a digital token on blockchain. For example:

• A $1,000 U.S. Treasury bond can be divided into 1,000 blockchain tokens priced at $1 each.

• A $1 million apartment can be fractionalized into 10,000 tokens, each representing a stake of ownership.

• Commodities like gold can be represented by tokens fully backed by vault-stored bullion.

The result assets that were once illiquid, geographically restricted, or limited to wealthy investors can now be accessible globally, traded instantly, and integrated into DeFi applications. World Economic Forum once predicted that tokenized assets could represent $16 trillion by 2030. In 2025, updated forecasts suggest that RWAs could account for 5–10% of global GDP ($20–30 trillion) within the next decade.

Why RWAs Are Exploding in 2025

1. Rising Interest Rates and Treasury Demand: With interest rates elevated worldwide, tokenized government bonds are thriving. Platforms like Ondo Finance and Superstate offer tokenized U.S. Treasuries, attracting billions in on-chain liquidity. According to 21.co Research, tokenized Treasuries grew more than 1,000% in 2023–2024, reaching over $1.5 billion and continue to accelerate in 2025.

2. Institutional Adoption: When BlackRock launched its tokenized fund BUIDL on Ethereum in March 2024, it marked a turning point. Within months, it attracted over $500 million in assets, showing that traditional giants see tokenization not as a “crypto fad,” but as the next infrastructure of finance. JPMorgan’s Onyx platform processed more than $1 trillion in tokenized intraday repo transactions in 2023, and in 2025, it continues to expand into cross-border settlements.

3. DeFi Integration: MakerDAO has restructured its business around RWA. By allocating billions of its reserves into short-term U.S. Treasuries, Maker generates stable yield for DAI holders, bridging TradFi and DeFi like never before. This strategy has not only stabilized Maker’s ecosystem but also demonstrated how DeFi protocols can outcompete banks in efficiency.

Case Studies

Case Study 1: BlackRock’s BUIDL Fund – In March 2024, BlackRock the world’s largest asset manager introduced BUIDL, its first tokenized fund on Ethereum. The fund invests in U.S. Treasuries and repo agreements, with investors receiving BUIDL tokens representing shares.

• Within 6 months: $500M+ AUM

• Investors: Accredited, but accessible globally without traditional settlement delays

• Custody: Managed by Securitize, a registered transfer agent

This case highlights institutional trust in Ethereum as a base layer for global financial infrastructure.

Case Study 2: MakerDAO and Centrifuge – MakerDAO’s RWA vaults in partnership with Centrifuge allow tokenization of assets like invoices, real estate loans, and trade finance. As of early 2025, Maker has deployed over $3 billion into RWAs, generating significant yield for DAI holders. Centrifuge facilitates this by enabling SMEs (small/medium enterprises) to tokenize real-world collateral, making capital accessible at DeFi-level rates.

Case Study 3: JPMorgan Onyx – JPMorgan’s Onyx Digital Assets processes tokenized repo and intraday liquidity transactions. In 2023, it crossed $1 trillion in settlements, and by 2025, the platform is exploring cross-border applications with Singapore’s MAS and the UAE. The Onyx example shows how blockchain’s efficiency reduces settlement risk, potentially saving banks billions annually.

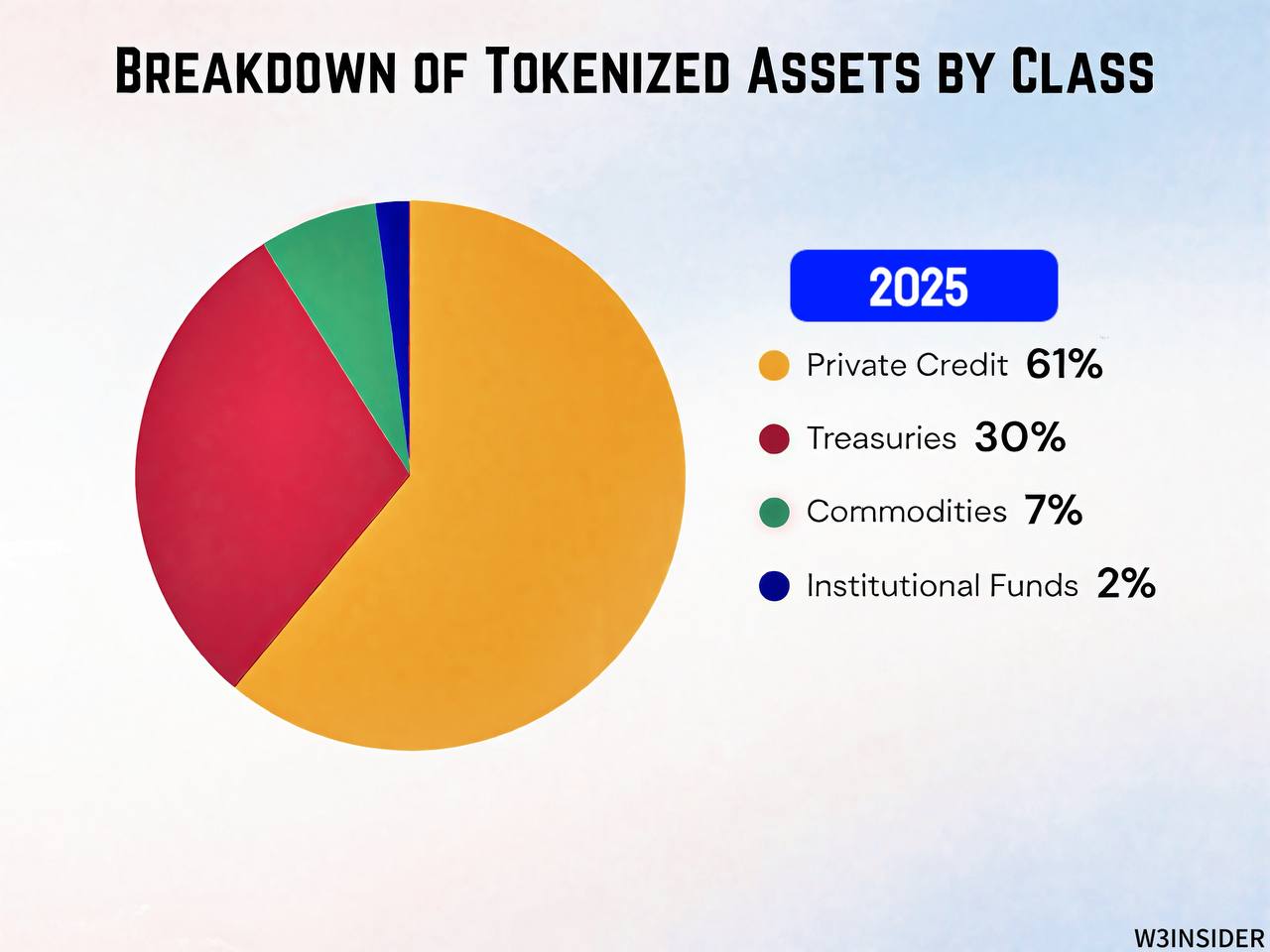

Key Sectors of RWA Tokenization

• Government Bonds: Most active sector, with Treasuries leading growth.

• Real Estate: Companies like RealT and Lofty AI allow fractionalized ownership of rental properties.

• Commodities: Paxos’ PAXG (gold-backed token) already represents over $500M in vaulted gold.

• Private Credit: Protocols like Maple Finance and Goldfinch tokenize lending markets.

• Carbon Credits: Toucan and KlimaDAO focus on environmental assets, enabling transparent carbon trading.

The Challenges Ahead

1. Regulation: Governments debate whether tokenized assets fall under securities law. SEC scrutiny remains high.

2. Custody & Auditing: Trust requires transparent proof that every token is 1:1 backed by real assets. Failures here could be catastrophic.

3. Liquidity Fragmentation: Tokenized assets live on multiple blockchains (Ethereum, Solana, Avalanche), raising interoperability issues.

4. User Access: Many offerings remain limited to accredited investors contradicting Web3’s open-access ethos.

The Future Outlook

By 2030, most analysts agree that tokenization will be a multi-trillion-dollar sector. BlackRock’s CEO Larry Fink himself declared in 2024 that the “next generation for markets will be the tokenization of securities.” Projects are moving toward permissioned-public hybrids: regulated access but on open blockchains. The European Union’s DLT Pilot Regime is already experimenting with tokenized securities in regulated environments. At the same time, DeFi-native solutions (like Maker, Centrifuge, Maple) are pushing for borderless participation, balancing compliance with decentralization.

Tokenized real-world assets stand as the bridge between TradFi and DeFi, merging the trust of traditional institutions with the speed, transparency, and accessibility of blockchain. Whether it’s BlackRock launching tokenized funds, MakerDAO transforming stablecoin reserves, or JPMorgan executing trillion-dollar repo transactions, the message is clear: tokenization is no longer theory it’s execution.

By 2030, it’s not unrealistic to imagine a world where your house deed, your savings bond, and even your concert tickets exist as blockchain tokens in a wallet you fully control.

Would you invest in tokenized government bonds or real estate if they were accessible on-chain today? Do you see RWAs as the ultimate driver of mainstream blockchain adoption or just another finance experiment? Share your thoughts in the comments we’d love to hear how you see the RWA market evolving.