Ethereum Layer-2 scaling solutions in 2025 are transforming blockchain. Explore zk-rollups, Optimistic rollups, RaaS, and their impact on DeFi, NFTs, and gaming.

Ethereum remains the backbone of the decentralized web, powering more than 65% of DeFi TVL (Total Value Locked) and the majority of NFT marketplaces. Yet, for years, it has struggled with scalability: high gas fees and slow confirmation times have limited mainstream adoEption. In 2025, however, the narrative is changing. With the rise of Layer-2 scaling solutions, Ethereum is achieving transaction speeds once unimaginable and enabling affordable, scalable applications for millions of users worldwide.

The Evolution of Layer-2 Scaling

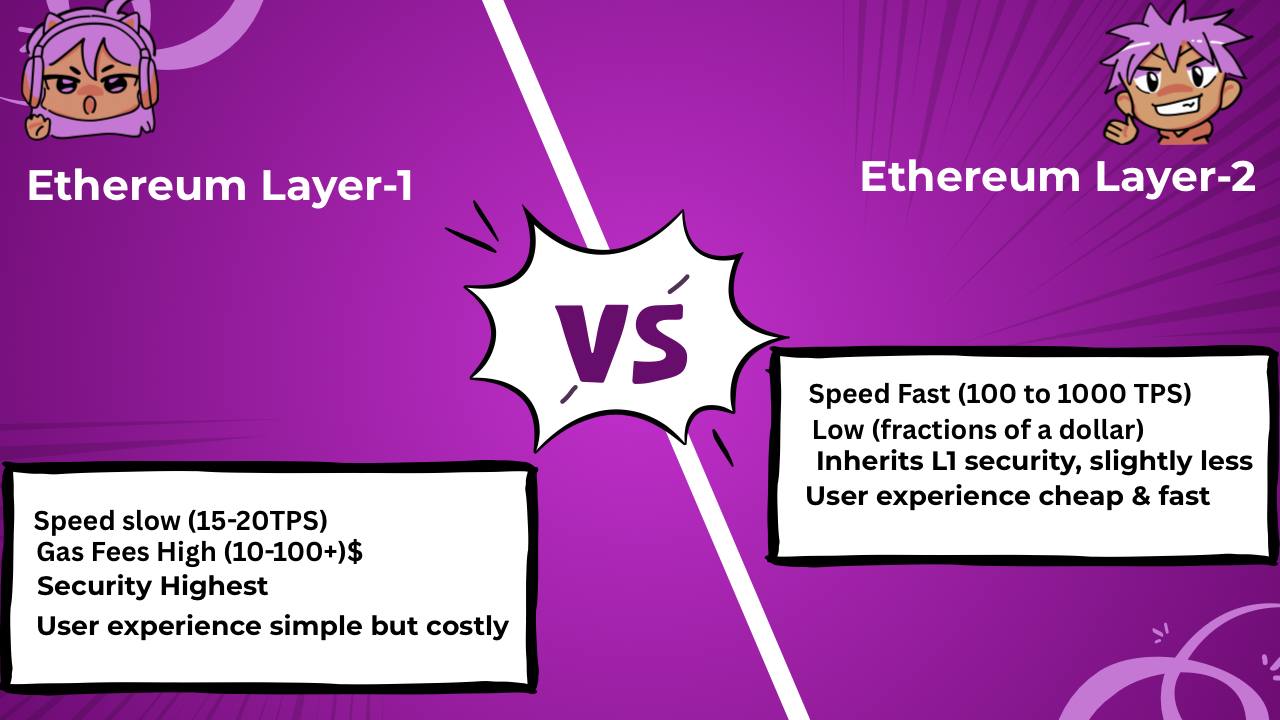

Layer-2 (L2) refers to protocols built on top of Ethereum that process transactions off-chain while still benefiting from Ethereum’s security. The two leading approaches are:

In 2025, both have matured, with zk-rollups now seen as the “gold standard” for security and scalability.

Current Leaders in Layer-2

Optimism: Optimism is widely adopted, especially for DeFi platforms. By batching transactions, Optimism reduces fees by nearly 90%. It also powers OP Stack, which other projects use to create custom L2 chains.

Arbitrum: Arbitrum dominates in terms of adoption, securing over $12 billion TVL in 2025. Its reliability and developer-friendly design have made it a preferred choice for NFT platforms and DeFi.

zkSync: zkSync has gained traction with zk-rollup technology, offering instant withdrawals and near-zero fees. Projects like Curve Finance (https://curve.fi/) and dYdX (https://dydx.exchange/) already deploy zkSync for lightning-fast DeFi trades.

Beyond Rollups (RaaS and Modular Scaling)

Ethereum scaling has evolved beyond basic rollups. The latest trend is RaaS (Rollup-as-a-Service), allowing businesses and DAOs to deploy custom rollups without needing deep technical expertise (Alchemy RaaS guide). Modular rollups where execution, data availability, and settlement are separated are also gaining momentum. Combined with hardware-accelerated cryptography, they make Ethereum more enterprise-ready than ever before.

Real-World Impact of Layer-2 in 2025

Challenges Remaining

- User Experience and Accessibility: While Layer-2 solutions significantly reduce fees and improve transaction speed, the user experience is still far from seamless. New users often find it confusing to bridge assets between Ethereum Layer-1 and different L2 networks. Wallets, dApps, and interfaces are not yet fully standardized, which creates friction in onboarding mainstream users. Until the process feels as smooth as using traditional web applications, adoption will remain limited.

- Liquidity Fragmentation: With multiple L2s available—such as Arbitrum, Optimism, zkSync, StarkNet, and more—liquidity is spread across separate ecosystems. This fragmentation reduces efficiency in DeFi markets and complicates cross-chain transactions. Bridging solutions exist, but they add costs, risks, and time delays. A unified liquidity layer or stronger interoperability between L2s will be necessary for long-term scalability.

- Security and Trust Assumptions: Although L2s inherit security from Ethereum Layer-1, they also introduce new trust models. Optimistic Rollups rely on fraud proofs and challenge periods, which can lock up user funds for up to seven days. ZK Rollups reduce withdrawal time but require highly complex cryptography that is difficult to audit. Additionally, many L2s depend on centralized sequencers, creating concerns about censorship and downtime. Ensuring full decentralization and robust security is still a work in progress.

- Developer and Ecosystem Fragmentation: Each L2 has slightly different technical implementations, development frameworks, and tooling. For developers, this creates challenges in deploying applications across multiple networks. Instead of focusing on building innovative dApps, teams often spend extra time adapting their code for different rollups. Standardization efforts like EIP-4844 (Proto-Danksharding) and shared tooling may ease this, but until then, developer resources are diluted.

- Economic Sustainability: The long-term economic model for L2 networks remains uncertain. Since they depend on Ethereum for data availability and final settlement, they must pay fees to the Ethereum mainnet. If Ethereum gas prices rise significantly, the cost advantage of L2s could diminish. Additionally, many L2 networks subsidize users with incentives today, but sustaining those incentives without strong revenue streams could become difficult in the future.

Ethereum Layer-2 has solved critical problems of scalability and cost, but challenges remain in user experience, liquidity fragmentation, security models, developer adaptation, and economic sustainability. Overcoming these will be key for Ethereum to achieve mass adoption. However, ongoing innovation continues to address these issues. Bridges are becoming more seamless, and wallets like MetaMask are integrating native L2 support.

At a glance, Layer-2 solutions are no longer an experimental fix—they are the core scaling strategy for Ethereum. By cutting fees, increasing throughput, and broadening use cases, they are transforming Ethereum into a truly global settlement layer for the decentralized internet.

Have you used Ethereum on Layer-2? Was your experience faster and cheaper than Layer-1? Drop your feedback below and let’s compare experiences