Explore how tokenization of real world assets (RWA) like real estate, bonds and commodities is reshaping stats and market projection included.

For decades, financial institutions have searched for ways to make traditionally illiquid assets like real estate, art or private equity more accessible. In 2025, that search has found a powerful answer: tokenization of real world assets through blockchain technology. this transformation is not a theoretical idea. It’s already happening. Major banks, governments and fintech startups are launching tokenized products that allow investors to trade fractions of real estate, U.S. treasuries, gold and even fine art directly on-chain. According to Boston Consulting Group report, the global tokenized assets market could reach $16 trillion by 2030, making it one of the most important financial trends of this decade.

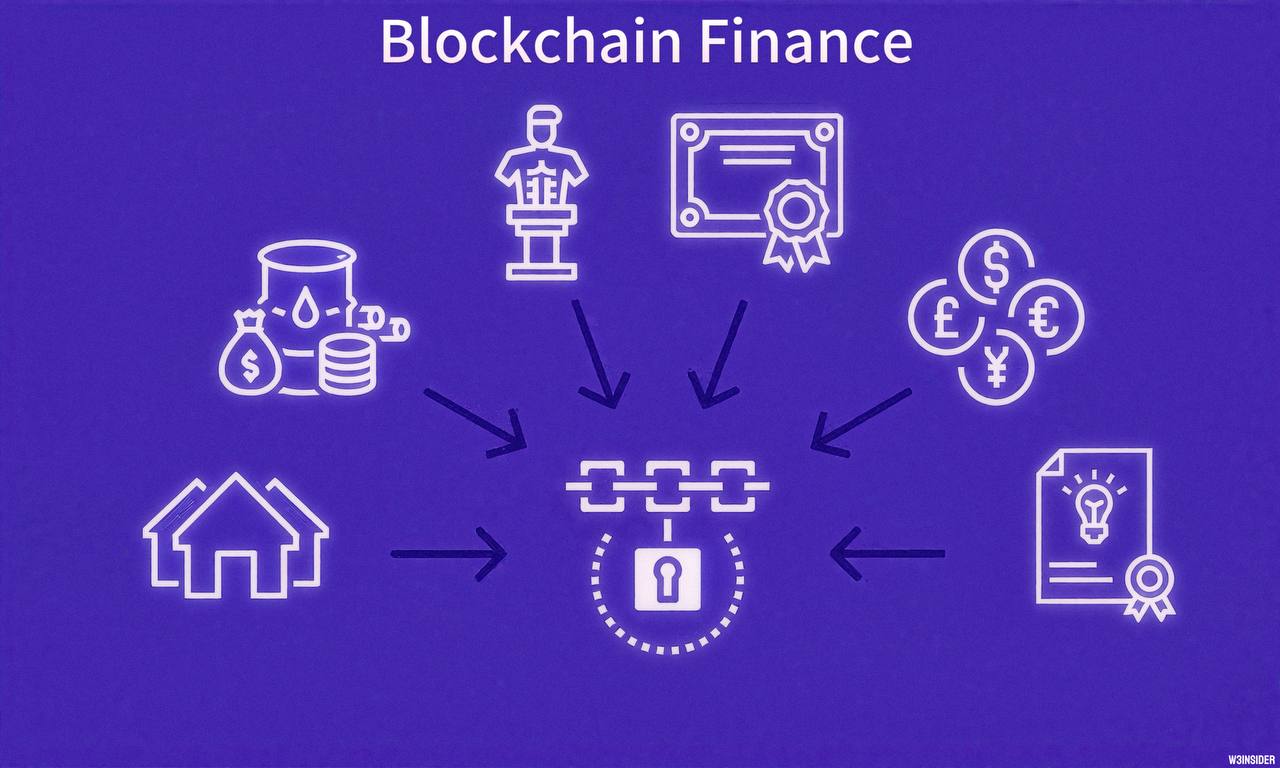

What Is RWA Tokenization?

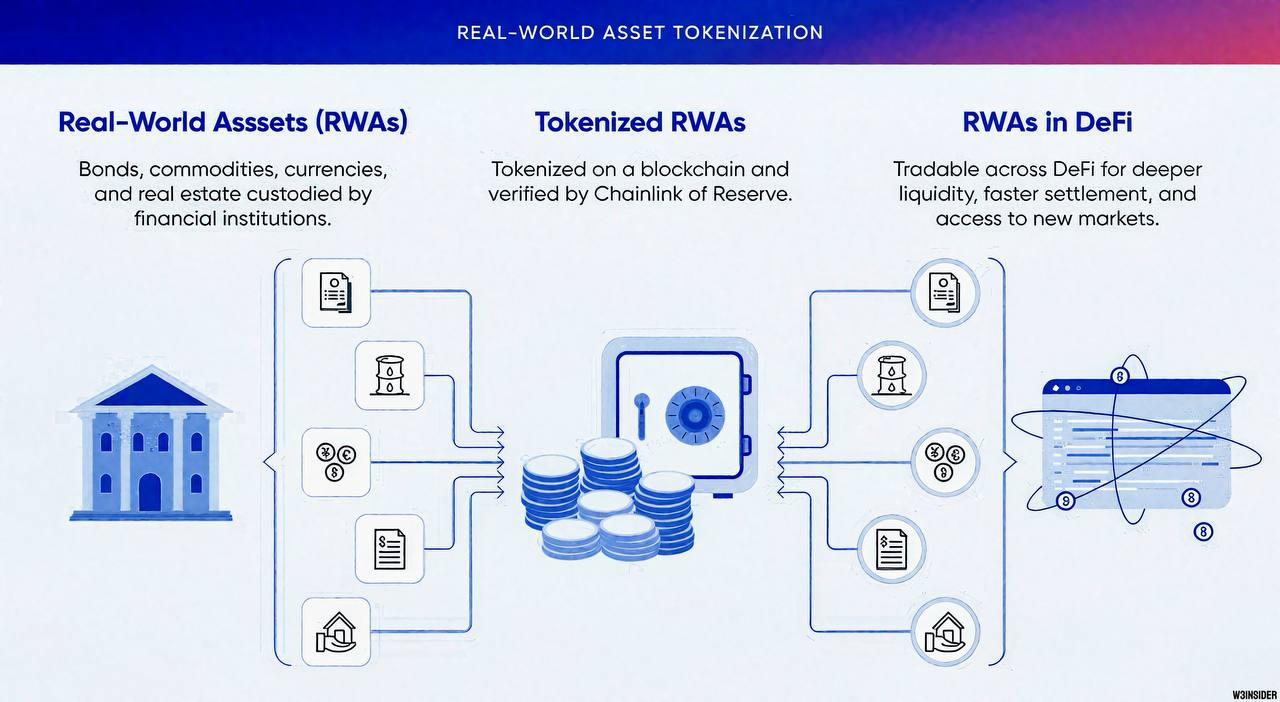

At its core, RWA tokenization is the process of converting ownership rights of a physical or traditional financial asset into a digital token recorded on a blockchain.

• Real Estate: Property ownership is fractionalized into tokens.

• Bonds & Treasuries: Investors buy tokenized debt instruments with smaller entry amounts.

• Commodities: Gold, oil, and agricultural goods are represented digitally, allowing 24/7 trading.

• Private Equity: Venture capital stakes are opened to smaller investors through tokenized shares.

These tokens can then be traded peer-to-peer, collateralized in DeFi protocols, or held as long-term investments, offering far greater flexibility than traditional systems.

Why RWA Tokenization Matters in 2025

The financial world is increasingly digital, but legacy systems remain slow, expensive, and inaccessible to most people. Tokenization solves these issues:

• Liquidity: Illiquid assets like real estate can be bought/sold in fractions.

• Accessibility: Minimum investments shrink from thousands of dollars to as little as $10.

• Transparency: Ownership is tracked immutably on blockchain.

• Efficiency: Settlement times drop from days/weeks to minutes.

As Larry Fink, CEO of BlackRock, put it in a 2024 interview: “The next generation for markets, the next generation for securities, will be tokenization of securities.”

Case Studies of RWA in Action

1. Franklin Templeton’s On-Chain U.S. Treasuries: In 2023, Franklin Templeton launched the first U.S. Treasury-backed mutual fund on Polygon. By 2025, it has grown into a multi-billion dollar product, attracting crypto investors who want safe, yield-generating assets on-chain.

2. Real Estate Tokenization in Europe: A luxury apartment block in Paris was tokenized on Ethereum Layer-2, allowing investors to buy shares of the property for as little as €100. Within 3 months, over 3,000 investors participated, showing strong appetite for democratized property investment. This model is now expanding to Spain, Germany, and the UAE, where governments are supporting blockchain-based real estate registries.

3. Gold-Backed Tokens in Asia: Platforms like Paxos and Tether Gold (XAUT) have seen explosive demand in 2024–2025 as Asian investors seek blockchain-based alternatives to physical gold. The total value of gold-backed tokens surpassed $1.5 billion in circulation by early 2025.

Adoption Trends in Numbers

1. Market Size: RWA tokenization market reached $3.1 billion TVL (total value locked) in DeFi protocols by Q2 2025 (DefiLlama). Forecast $16 trillion tokenized assets by 2030 (BCG).

2. Investor Demographics: 45% of RWA investors in 2025 are under 35 years old. Emerging markets (India, Nigeria, Brazil) show faster adoption due to lack of traditional access.

3. Institutional Adoption: BlackRock, JPMorgan, and Citi are experimenting with tokenized funds. Governments in Singapore and Hong Kong are launching regulatory sandboxes for tokenized bond issuance.

Case Study on Tokenized Bonds in Singapore

In 2024, the Monetary Authority of Singapore (MAS) issued $300 million worth of tokenized government bonds on a permissioned blockchain. Settlement times dropped from T+2 days to under 10 minutes, saving millions in operational costs. By 2025, Singapore is positioning itself as a global hub for tokenized finance, drawing interest from European and Middle Eastern sovereign funds.

Risks and Challenges

Despite its potential, RWA tokenization faces serious hurdles:

• Regulation: Securities laws vary globally. Many projects face uncertainty about compliance.

• Custody: How to guarantee that tokenized assets are truly backed by their real-world counterpart.

• Technology: Scalability and interoperability issues remain between blockchains.

• Adoption Curve: Educating traditional investors is still a major challenge.

Market Outlook of What's Next for RWA

Experts predict three major trends for the next 5 years:

1. Integration with DeFi: Tokenized treasuries and real estate will increasingly be used as collateral in lending protocols, providing safer yields.

2. Institutional Takeover: Banks and asset managers will dominate issuance, creating trusted tokenized markets.

3. Cross-Border Investments: Fractional ownership will allow investors in Africa to buy a share of New York real estate or Asian bonds seamlessly.

By 2030, tokenized markets may be as common as ETFs are today bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi).

Real-world asset tokenization is not hype it’s happening now, with billions already on-chain and trillions projected by 2030. By increasing liquidity, access, and efficiency, tokenization has the potential to fundamentally reshape how financial markets operate. The future of finance will not just be digital it will be decentralized, tokenized, and global.

Would you buy a fraction of a New York skyscraper or a tokenized U.S. Treasury bond if it was available through your crypto wallet? Do you trust tokenized products as much as their real-world counterparts? Share your opinion because whether we’re ready or not, RWA tokenization is shaping the financial landscape of tomorrow.